|

BARCLAYS BANKING ACCOUNT CLOSURE, PECUNIARY ADVANTAGE & THE FRAUD ACT 2006

|

|

|

BARCLAYS BANK - The Heritage Trust had arranged to launch the story of how Herstmonceux Museum was re-discovered and saved from oblivion, but Barclays Bank put a spanner in the works by closing down an account that was to be used for this purpose - this was despite asking if the account was needed, and being told about the planned publication project - by recorded delivery. The Trust have recently written to Jes Stayley and John McFarlane about this matter, but so far the duo have passed the buck, trying to avoid direct involvement, though they are the controlling minds of the company. In closing this account and copping hold of the money in it, it appears as though Barclays may have committed a criminal offence as per Section 4 of the Fraud Act 2006. As of November 22 2016, Barclays said they would looking again at this matter with hopes of a resolution, though the Financial Services Ombudsman was suggested by the bank to be a necessary pit stop, in fact the FSO could offer no assistance, leaving it to the authorities are not to take over to help find the money that is missing!

FUND RAISING & BANKING

The Trust had arranged to launch the story of how Herstmonceux Museum was re-discovered and saved from oblivion, but Barclays Bank put a spanner in the works by closing down an account that was to be used for this purpose. Barclays Bank has had a number of Chief executive officers and Chairmen since 2010, when they got caught red-handed fixing rates.

Banking should be open and honest. Every person and organization should have an entitlement to an account even if it is infrequently used. These institutions are there to serve the public, but instead cream off massive salaries and bonuses, all the while scheming to fix deals so that they continue to profit for shareholders that do nothing to earn a wage, but speculate on the efforts of others, so enslaving those who in our present society, are forced to borrow money to survive - making them slaves to banks. Financial Slavery should be abolished. Banking should be rigidly controlled with compensation schemes for those who are deprived of services or otherwise discriminated against.

It is alleged that Barclays Bank acted to close an account that was in good standing. The method used to close the account that was not earning them money for 'fat cat' bonuses was to send a letter advising that that was their intention, but with no explanation as to where the money deposited would go.

The Trust wrote back to Barclays by recorded delivery, explaining that the account was needed in connection with the fund-raising publication - and to please keep the account open. But closed it was, in breach of contract and in denial of the right to a bank account.

The bank finally offered compensation for the trouble of the Trustees to 2014 of just over a £hundred pounds, but failed to reopen the account or the give back the money they had defrauded the Trust of. There has so far been no mention of lost opportunity or just satisfaction for Human Rights violations. We find it incredible that "Fat Cat" executives can value the efforts of people trying to conserve history so low, while they make off with £millions. It appears from this very ordinary and everyday story that nothing much has changed at Barclays. Clearly this mess in not of the making of James Staley and John MacFarlane, but they now know about it and ultimately, decide how to put things right.

2010 - BOB DIAMOND & JERRY LES MISSIER - American-born investment banker Bob Diamond ended his less than two year run as Barclays’ CEO in July 2012, when he became the first major casualty of the Libor interest rate rigging scandal. His run at the top was good when it lasted though - he was the world’s second-highest paid banking boss in 2011, even though the group’s return on equity dropped from 7.2 to 5.8 per cent that year, and its share price underperformed the overall banking sector by dropping almost a third.

Del Missier followed Bob Diamond, whose surprise resignation came in the wake of revelations that some of the bank's traders fixed the London Interbank Offered Rate (Libor) in order to benefit their trading positions.

2012 - ANTONY JENKINS - Saint Antony was fired by chairman John McFarlane, a gruff Scottish banker nicknamed Mac the Knife for his take-no-prisoners attitude. It was said that Jenkins failed to make enough headway cutting the forest of bureaucracy engulfing Barclays, and struggled to improve the performance at the investment bank. Barclays ousted its chief executive of three years with a £2.4million golden parachute only hours before the Chancellor took to his feet to deliver the Budget.

Mr Jenkins extracted more than £5million last year and a string of long-term incentives yet to pay out, despite the fact the lender has yet to recover fully from the crisis. McFarlane denied that Barclays had deliberately put out the news of his departure on Budget day, when all eyes would be on George Osborne.

2015

- JAMES STALEY - Laughing all the way to the bank! In a memo to staff

Jes said: “I feel keenly we must continue to strengthen trust in Barclays. The trust of our customers and clients, reciprocated in our commitment and service to them, is the foundation of our success, the most valuable quality we can nurture and the key to unlocking shareholder value.

FRAUD COMPENSATION - NEVER SIR - MAIL ONLINE 14 OCTOBER 2015

According to the Mail Online, Barclays customers are four times less likely to receive compensation for fraud than with other high street banks:-

Barclays is four times more likely to refuse customers refunds after frauds than other banks, it has emerged.

Fraud victims can spend up to year fighting to get their money returned, the figures reveal.

THE TIMES - OCTOBER 14 2015

Barclays is up to four times more likely to deny customers a refund for fraud than other high street banks, an investigation by The Times has found.

FORCED ACCOUNT CLOSURES

A ruse to sweep monies from legacy savings and other accounts into Barclays coffers may be a fraud occasioned by this bank on a scale yet to be investigated. Banks are institutions that are bound by the tenets of the Fraud Act 2006, wherein it is clear that a failure to safeguard the financial interests of their account holders constitutes an act of fraud regardless of whether or not it was intentional.

As to intention, it is clear from the effort that goes into the copious mailings targeting accounts that are less used, that it appears that this bank thinks that it is unlikely that account holders will notice if they close accounts and hold on to the monies that are lodged therein. Clearly, correspondence from concerned account holders seeking to preserve their assets is being ignored - which tends to suggest that there never was a mechanism to deal with letters from account holders to keep their accounts open in the first place.

Those that do make a fuss are offered derisory sums that they cannot cash in any case, because the account that it is made payable to is closed. Such offers are therefore disingenuous and pay no heed to consequential losses or lost opportunities.

The fact that those who use accounts less are targeted is a potential violation of Article 14, as it discriminates against those with smaller deposits and lesser activity in favour of those with larger sums who use their accounts more often. It's a very fine line between efficiency and fraud and discrimination. On this occasion it looks as though those lines may have been crossed.

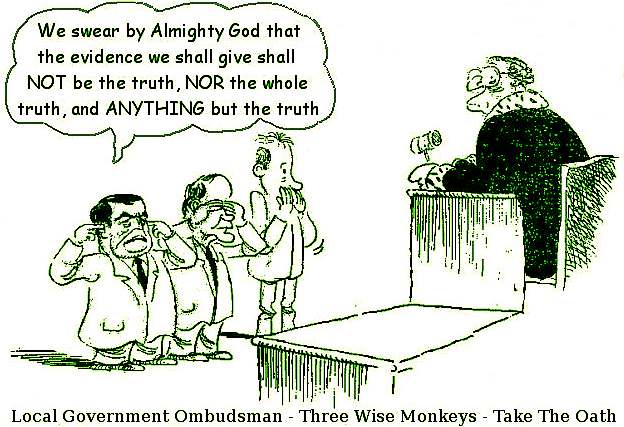

IT'S NOT JUST COUNCILS TELLING FIBS - Banking also has its fair share of dubious officers.

LINKS & REFERENCE

http://www.halifax.co.uk/ https://www.hsbc.co.uk/ http://www.nationwide.co.uk/ https://www.lloydsbank.com/ http://personal.natwest.com/ http://www.thetimes.co.uk/ http://www.bankofengland.co.uk/ http://www.legislation.gov.uk/ukpga/2006/35/contents http://www.wealden.gov.uk/ http://www.thetimes.co.uk/tto/money/consumeraffairs/article4585077.ece http://www.dailymail.co.uk/news/article-3272061/Barclays-four-times-likely-deny-fraud-victims-refund-banks.html

MAC

THE KNIFE - When John McFarlane took over as Barclays chairman in

May 2015, investors were thrilled. Here was an experienced banker with a no-nonsense style whose arrival would herald a

turnaround in the bank’s faltering performance.

2012 - SIR DAVID ALAN WALKER - Was born on the 31st of December 1939. He is a British banker and former chairman of Barclays. He was chairman of Morgan Stanley International from 1995 to 2001, and 2004 to 2005, and remains a senior advisor, somewhat confusingly, since we would have thought that was a conflict of interest for the Monopolies Commission to look into.

Walker was previously Assistant Secretary at the Treasury (1974–77), chairman of the Securities and Investments Board (1988–92), executive director for finance and industry at the

Bank of England (1989–95) and deputy chairman of Lloyds TSB (1992–94). In 1994 he also joined the Washington-based financial advisory body, the Group of Thirty.

2012

- MARCUS AGIUS

- Barclays’ tainted chairman Marcus Agius will pocket a £375,000 payoff in October when he leaves the bank to make way for his replacement, Sir David Walker.

2010 - FAT CAT IN THE HAT - Ricci Rich's massive pay-cheques and flamboyant behaviour no longer struck the right chord after the bank was hit with a £290m fine for rigging Libor, and at a time when Britons were being forced to tighten their belt.

Ricci was by Diamond's side when he began the 14-year process of turning Barclays' defunct investment bank, BZW, into what was to become Barclays Capital. Ricci was in New York when Diamond failed to save the ailing US bank Lehman Brothers from bankruptcy in September 2008 – only to then take control of the Wall Street operations of the collapsed bank days later.

HERITAGE INDEX A - Z

BARCLAYS BANKING LET DOWN - MISSING ACCOUNT MONEY BARON CARL VON ROEMER & CHARLES de ROEMER CAMPBELL HALL - BLUEBIRD ELECTRIC CARS GAS ENGINES - COAL CONVERSION, INTERNAL COMBUSTION OBSERVATORY - HERSTMONCEUX CASTLE SOLAR LADY - STATUE

GOOGLE MAPS - The detail is not that great and the situation on the land is significantly changed in that the site has undergone a massive clean up.

|

|

|

This website is Copyright © 2017. All rights reserved. All other trademarks are hereby acknowledged. Contact Us www.cherrymortgages.com |